Uganda is emerging as a particularly attractive destination for both foreign direct investment and sustainable tourism development. This analysis brings together economic, demographic, infrastructural, and environmental evidence to show why the country offers a strategic environment: from its macroeconomic trends and fiscal outlook to demographic dynamics and labor-market potential; recent improvements in energy and transport capacity; its comparative advantages in nature-based tourism; and the policy instruments that lower entry costs for investors. Each argument is supported by empirical sources that strengthen the overall conclusions.

Uganda – Key Economic Indicators

| Indicator | Most Recent / Estimated Value |

|---|---|

| Real GDP Growth (FY 2023/24) | 6.1% |

| Projected GDP Growth (FY 2024/25) | 6.2% |

| Inflation (FY 2023/24) | 3.2% |

| Public Debt / GDP Ratio | ~52% |

| Nominal GDP (2023) | USD 48.77 billion |

| GDP per Capita (2024) | ~USD 986.8 |

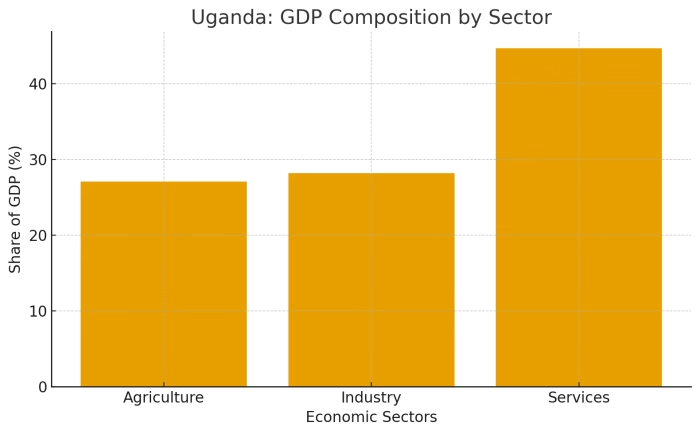

| Agriculture Share of GDP | ~27.1% |

| Industry Share of GDP | ~28.2% |

| Services Share of GDP | ~44.7% |

Why Uganda?

- Macroeconomic trajectory and growth prospects

Uganda has demonstrated resilient growth in recent years and entered the mid-2020s with a favorable macroeconomic outlook. Multilateral projections indicate real GDP growth rates in the mid-single digits with upward pressure expected from expansionary public investment and nascent extractive-sector activity. This macroeconomic momentum, together with moderated inflation, creates a comparatively benign environment for capital deployment and medium-term returns.

- Demography as a potential demographic dividend

Uganda’s population structure is strongly youthful: nationally representative census and demographic releases show a population with a very large share of children and young adults. A broad-based youthful cohort implies a growing labour supply and expanding domestic consumption over the next two decades, conditional on effective investments in education, health and labour-market integration. From an investor perspective, a young workforce reduces unit labour-cost growth and enables scaling of labour-intensive manufacturing, agro-processing and services where training can rapidly increase productivity.

- Energy and infrastructure — reducing production constraints

Energy availability is frequently a binding constraint for industrialisation in Sub-Saharan contexts. Uganda has materially increased its installed generation capacity through recent hydroelectric projects (notably Isimba and Karuma) and is actively piloting complementary technologies (e.g., floating solar). By mid-2024 the country’s installed capacity exceeded 2 GW, with renewables comprising the large majority—an improvement that lowers operational risk for energy-intensive industries and supports electrification of manufacturing clusters and cold-chain logistics. Infrastructure upgrades in transport corridors further augment Uganda’s position as a land-linked hub for East and Central African trade.

- Comparative advantage in biodiversity and nature-based tourism

Uganda’s protected areas host globally significant biodiversity assets—most prominently populations of mountain gorillas in Bwindi Impenetrable and Mgahinga National Parks. Gorilla tourism, combined with freshwater and montane ecosystems (including the source regions of the Nile and Lake Victoria basin), generates high-value, low-footprint tourism demand. Empirical conservation-economy linkages demonstrate that well-structured ecotourism can produce both conservation rents and local livelihood benefits when revenues are partially retained at community level. For tourism investors, Uganda offers a portfolio of under-exploited high-yield tourism products relative to more saturated regional markets.

- Policy environment and investor facilitation

Ugandan investment promotion mechanisms provide procedural and fiscal incentives for qualifying projects. The statutory framework allows for negotiated incentives (tax holidays, customs relief, access to industrial land in designated parks) contingent on capital thresholds and sectoral priorities (e.g., agro-processing, value addition, industrial parks). Institutional facilitation through the national investment agency can materially shorten pre-operational timelines and mitigate entry friction for structured investments. Nonetheless, investors should undertake rigorous due diligence on contract terms and local content requirements.

- Sectoral opportunities and risk considerations

Sectors with immediate investment logic include: (a) agro-industrial processing that captures upstream raw-material value, (b) renewable energy generation and distributed mini-grids, (c) sustainable tourism infrastructure at premium price points, and (d) digital services and logistics which leverage the young, technologically receptive population. Key risks remain—political governance issues, land tenure complexity, and the need for continued improvements in rule-of-law and contract enforcement. Investors should pair capital with technical assistance, community engagement strategies, and impact metrics to enhance both social licence and long-run asset resilience.

From a scientific and policy-informed perspective, Uganda presents a composite of favourable factors for strategic investment: a positive macroeconomic baseline, a youthful labour endowment, improved energy capacity, unique biodiversity-based tourism assets, and formal mechanisms that reduce entry costs. These elements create windows of opportunity for investors pursuing both commercial returns and development impact. Successful engagement requires rigorous risk management, local partnerships, and long-horizon planning that aligns firm strategy with national development objectives and ecological carrying capacities.

Team ProdAfrica

team@prodafrica.com